11+ how to increase your home loan eligibility

Mortgage insurance is required for all mortgage loans with a loan-to-value ratio above 80. Ad Get the Best Rates For Your Mortgage Compare Top Companies and Get Great Deals.

7 Essential Tips To Reduce Home Loan Interest In 2022

Take the First Step Towards Your Dream Home See If You Qualify.

. Put 20 Down To Avoid Pmi. Get Started Now With Rocket Mortgage. The Feds latest move would raise its benchmark rate to a range of 375 to 4 the highest level in 14 years.

10 Jun 2020 0113 PM IST Tinesh Bhasin. Ad First Time Home Buyers. So far the Feds five hikes in 2022 have increased rates by a.

Ranking Criteria Trusted by Over 45000000. The best option is to apply for a home loan with your spouse andor parents. Credit scores reflect your creditworthiness.

Choose a Loan That Suits Your Needs. A longer tenure enhances your chances of timely loan repayment and hence increases your eligibility. In this article we will be talking about some tips that will help you increase your home loan eligibility also increase your chances of getting one.

Get a Quote Today. Get a Quote Today. Ad Apply online for a home or land mortgage loan through Rural 1st.

A home loan down payment is the amount of. 8 Factors that Increase Your Home Loan Eligibility Improve Your Credit Score. Check Your Eligibility for a Low Down Payment FHA Loan.

They are the first step in your loan application. Paying off your credit card dues in a timely manner improves your overall eligibility to obtain a home loan. Keep an eye on your credit score when planning to apply for a loan.

Ad Check Your Eligibility See If You Qualify for a 0 Down VA Loan. A basis point is equivalent to 001 The most frequently used loan term is a. Therefore try to opt for longer duration home loans if you wish to increase your home loan eligibility.

Mention all additional sources. Ad Get The Service You Deserve With The Mortgage Lender You Trust. Maintain Good Credit 2.

As and when you increase your loan tenure it. But top-yielding one-year CDs now offer as much as 4. Apply for a VA Loan Confirm Your Eligibility.

Many borrowers who are unable to service their loans have opted. This is because the banks see. Opt for Longer Tenure One of the most common ways to increase your eligibility for home loan is opting for longer duration loan.

It Only Takes Minutes to See What You Qualify For. Heres how to increase your loan eligibility. The average rate on a one-year credit union CD is 105 as of October 27 up from 014 at the start of the year.

A good credit score is a reflection of your repayment capability and helps improve your home loan eligibility. Mention Additional Income Sources. 1 day agoThe average 30-year fixed mortgage interest rate is 722 which is unchanged from one week ago.

Finance Your Dream Home with the Lowest Rates. Unless you have 20 down you will be required to. One must make sure that all loan repayments are done on time in order to accomplish that.

This would be the sixth rate raise in a row total. Use A Home Loan By Involving A Co-Applicant 4. Make a Sizable Downpayment.

Before you apply for home loan from the bank make sure you have cleared all the pre-existing loans you had taken. Always maintain a credit score greater than 750 out of 900 to increase your home loan eligibility and even helps you to avail lesser interest rate from the concerned loan. One of the best ways to improve your Credit Score is to.

Clear All Pre-Existing Loans. Choose A Longer Duration 3. The average rate for a 15-year fixed mortgage is 645 which is an increase of 2 basis points from seven days ago.

Get Your Estimate Today. Compared to a 30-year. Find loans for country homes land construction home improvements and more.

Adding co-applicants will not only be a good way to increase home loan eligibility but also a. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. 2 days agoThat means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt.

5 Best Ways To Enhance The Eligibility For A Home Loan. Take Joint Home Loans. Home loan eligibility is usually increased by having a high credit score.

Compare Mortgage Options Get Quotes. Taking a joint home loan Maintaining a. Ad Review 2022s Best VA Home Loans.

10 hours ago15-year fixed-rate mortgages. 4 min read. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Loan.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Trusted VA Loan Lender of 300000 Veterans Nationwide.

Help To Buy In Gloucester Michael Tuck Estate Agents

How Much Home Loan Can I Get Salary India India

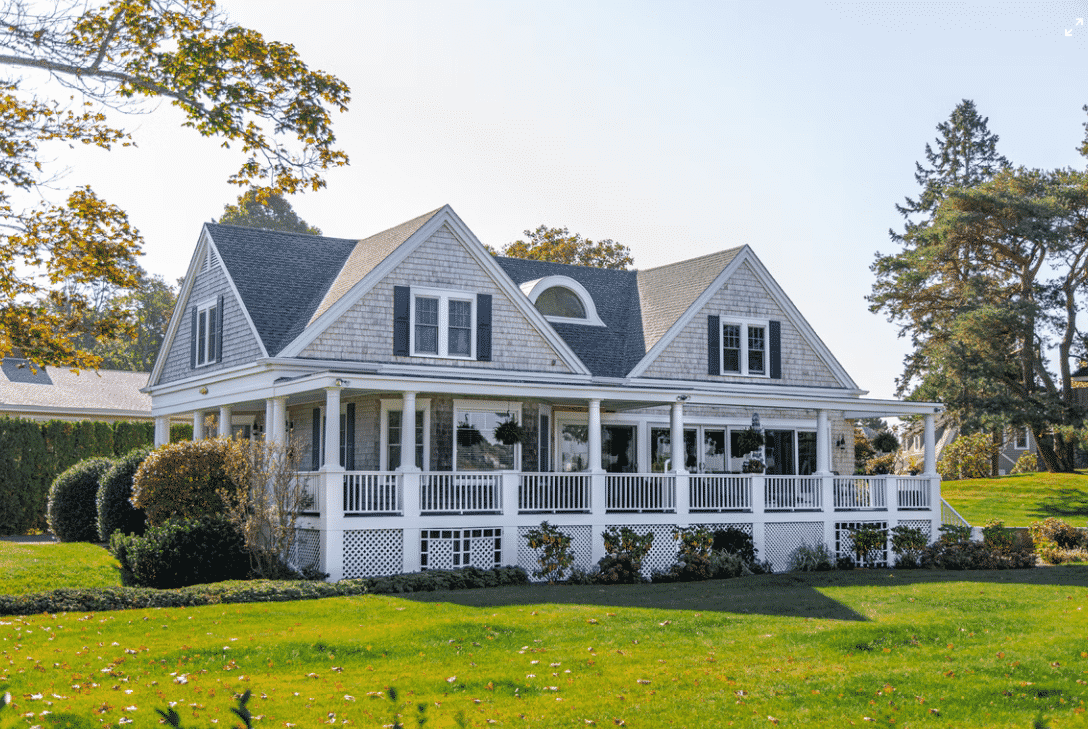

The Best Time Of Year To Buy A House Rocket Mortgage

Home Loan Eligibility Calculate Home Loan Eligibility Online

Borrowing More

Tips To Increase Your Home Loan Eligibility Finance Buddha Blog Enlighten Your Finances

Home Loan Eligibility Calculator Housing Loan Eligibility Indianmoney

6 Ways To Boost Your Home Loan Eligibility Roofandfloor Roofandfloor Blog

Secured Loans Vs Unsecured Loans Manappuram Finance

Home Loans In Tennessee 11 Best Tennessee Mortgage Lenders In 2022

Home Loan Eligibility Checklist 99acres Com

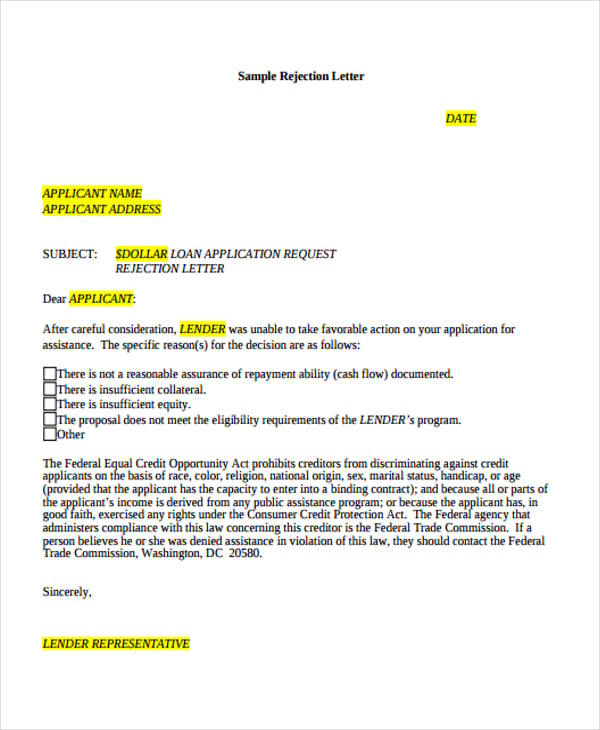

Loan Rejection Letter Templates 7 Free Word Pdf Format Download Free Premium Templates

5 Smart Ways To Boost Your Home Loan Eligibility The Financial Express

Understanding Home Loan Eligibility Hdfc

7 Ways To Increase Your Home Loan Eligibility Homeonline

6 Ways To Boost Your Home Loan Eligibility Roofandfloor Roofandfloor Blog

:max_bytes(150000):strip_icc()/dotdash-cash-out-vs-mortgage-refinancing-loans-final-53422e64e4034a31983633db51b0501f.jpg)

Cash Out Vs Rate And Term Mortgage Refinancing Loans