32+ florida mortgage intangible tax

Web The state transfer tax is 070 per 100. Web They are the Florida documentary stamp promise to pay tax and the Florida non-recurring intangible personal property tax.

Pdf C H A P T E R A Framework For Business Analysis And Valuation Using Financial Statements Anna Yang Academia Edu

So on a 140000 mortgage the Florida Intangible Tax would be 280.

. Please make note of this Ernst Lookup Change if you close files in Florida. Specific apportionment rules may apply if. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

No Tax Knowledge Needed. The Florida intangible tax is 2 mills. Web Florida Intangible Tax Change.

Web Florida Mortgage Intangible Tax. Web The intangible tax is imposed at the rate of 200 per 1000 two mills on each dollar of the secured amount 199133 1 Fla. Web They currently impose the intangible tax at a rate of 150 per 500 or 3 per 1000 of the loan amount.

For example the tax on a 100000 is 100000 x 0002 200. Web The net asset value of a business trust with taxable assets must be proportionately reduced if the portfolio of assets contains debt obligations of the United States Government. The Florida documentary stamp.

The Intangible Tax rate is 20 cents per 100 financed. That means a person financing a property for. Also on a mortgage intangible tax is due at the rate of 20 cents.

Documentary Stamp Tax at 35 per 100 rounded up based on the amount financed. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Non-recurring intangible personal property taxes are payable at the rate of 002 times the amount of the indebtedness secured by a mortgage on Florida real.

Not all states require intangible tax on loans and those that do can vary in the amount. Original or expected balance for your mortgage. You can calculate the cost using the same method for mortgage tax.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. That means a person financing a 550000 property pays. Web Intangible tax is calculated on the loan amount shown in the note.

Web Currently the intangible tax is imposed at the rate of 150 per 500 or 3 per 1000 based upon the loan amount. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Web Florida Documentary Stamp Tax Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. TurboTax Makes It Easy To Get Your Taxes Done Right. If you do not close files in Florida this does not apply.

There is an additional surtax of 045100 but only for multi-family or. Web The current documentary stamp tax fee for a mortgage is 35 cents per 10000 based on the mortgage amount. Taxpayers can deduct the interest paid on qualified residences for up to 750000 in total mortgage debt the.

Web 1 Any mortgage deed of trust or other lien given to replace a defective mortgage deed of trust or other lien covering the identical real property as the original and securing the. Web How much is the Florida intangible tax. Web Documentary Stamp Tax Intangible tax for Mortgages.

Taking Over A Seller S Loan The New York Times

Texas Oil And Natural Gas June 2016 Peak Oil Barrel

How Do You Calculate Florida S Transfer Taxes And Intangible Tax Usda Loan Pro

Menlo College Academic Catalog By Menlo College Issuu

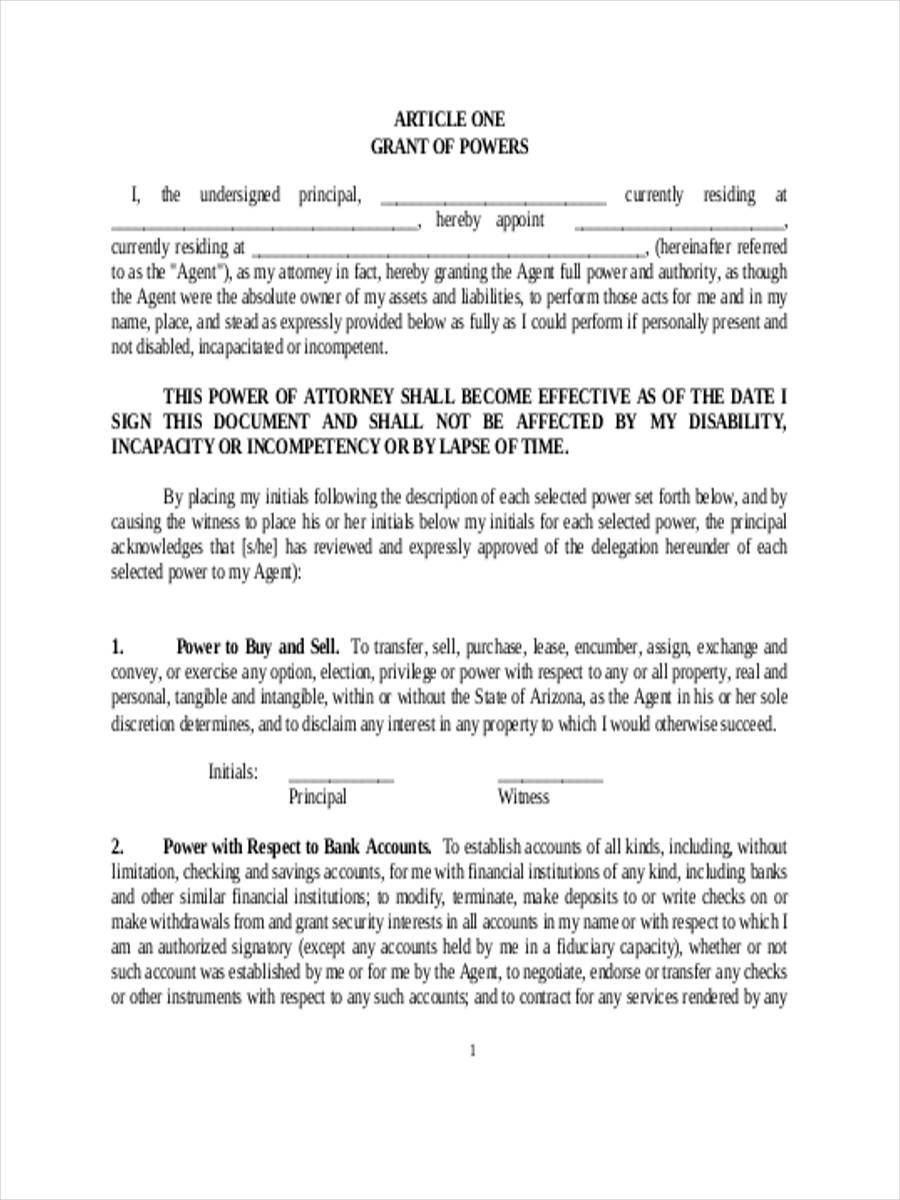

Free 6 Financial Power Of Attorney Forms In Pdf

Intangible Tax On A Mortgage Pocketsense

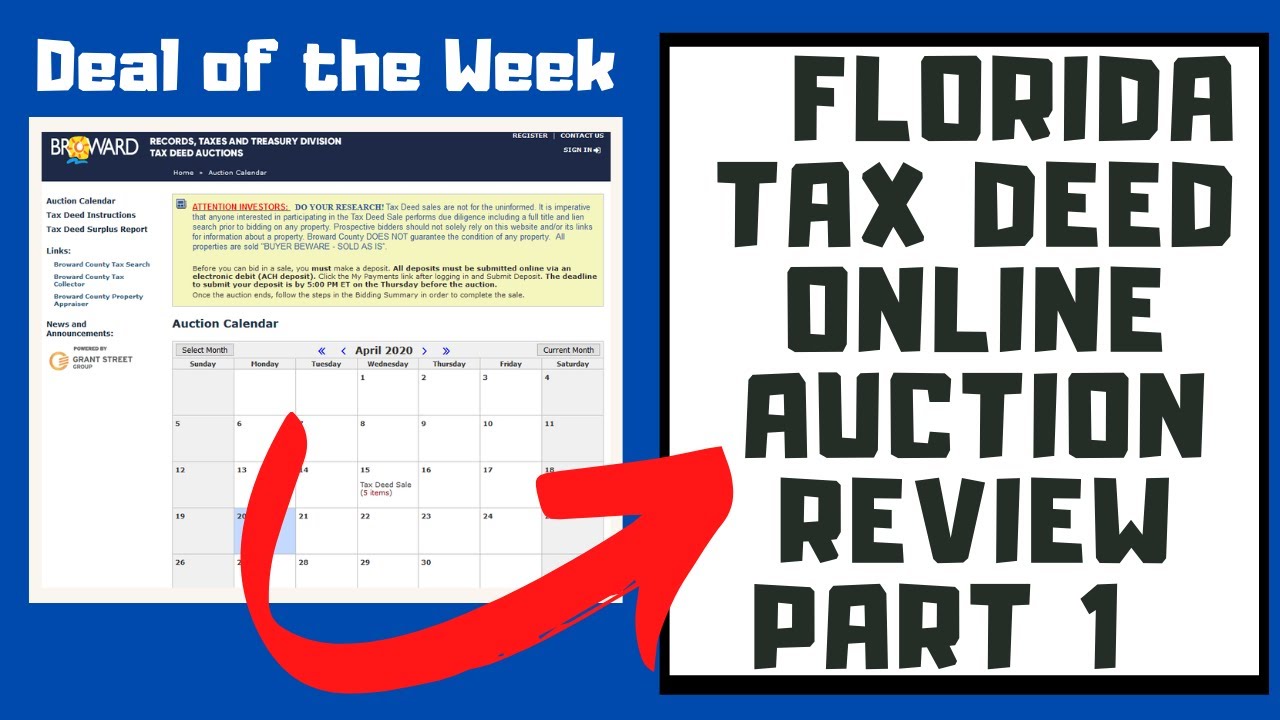

Florida Tax Deed Sales Part 1 Online Auction May 2020 Youtube

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

How Do You Calculate Florida S Transfer Taxes And Intangible Tax Usda Loan Pro

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Lowndes Article Detail

Florida Real Estate Principles Practices Law 39th Edition Ppt Download

Intangible Tax On A Mortgage Pocketsense

Research In The Community Vol 6 By Bay School Issuu

Intangible Tax On A Mortgage Pocketsense

Crain S Detroit Business Sept 5 2016 Issue By Crain S Detroit Business Issuu

Pultemortgageexecutedame